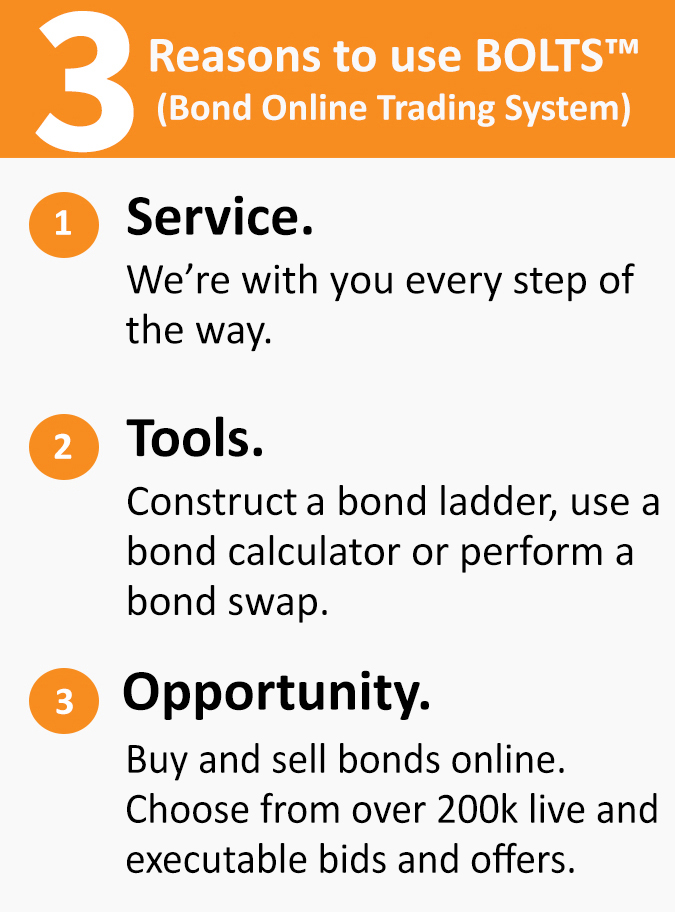

Experience Convenient Funding and Transfers at ACAP Trading

Open and fund your account and start trading the same day on most account types. If you have funds with another firm, a previous 401k, or another type of retirement account, ACAP Trading makes rollovers and transfers easy.

[su_tabs active=”1″][su_tab title=”Electronic Funding“]

Electronic Funding

Electronic funding of your online brokerage account is easy with ACAP Trading.

ACH services assist with the moving of funds to and from another bank account. There is no minimum initial deposit required to open an account with ACAP Trading.

Acceptable Electronic Funding Deposits

Electronic Funding Restrictions

[/su_tab]

[su_tab title=”Wire Transfer“]

Wire Transfer

Fund your ACAP Trading online brokerage accounts quickly and easily with a wire transfer.

There is no minimum initial deposit required to open an account. To avoid a rejected wire or a delay in processing your wire, please include your active nine-digit ACAP Trading account number on the wire. Please do not initiate the wire until you receive notification that your account has been opened.

Incoming Wire Transfer

Requests to wire funds into your ACAP Trading account must be made with your financial institution. Please have the bank include the sender name on the wire. This information must be included for the transfer to be credited to your account. A rejected wire may incur a bank fee. All wires sent from a third party are subject to review, require verification prior to acceptance and may be returned.

A wire from a joint bank/brokerage account may be deposited into an ACAP Trading account by either or both of the joint account owners.

A wire from an individual bank/brokerage account may be deposited into a Joint ACAP Trading account if that person is one of the ACAP Trading account owners.

Wire Transfers should be sent to ACAP Trading as follows:

- JP Morgan Chase Bank

- 270 Park Ave.

- New York, NY 10017

- ABA # 021000021

- Hilltop Securities, Inc.

- Account # 08805076955

- *For Further Benefit (FFB) of:

- Your nine-digit ACAP Trading account number

- Your name

*Required for timely and accurate processing of your wire request.

Please contact ACAP Trading, not Hilltop Securities, regarding questions or concerns about a wire transfer. Please do not send checks to this address.

Foreign Wire Transfer

Wire transfers that involve a bank outside of the United States are classified as foreign wires. Because these banks are not on the Federal Reserve System, an intermediary U.S. bank is needed. Along with the name and address of the intermediary bank, a SWIFT code or a sort code needs to be included. All wires sent from a third party are subject to review, require verification prior to acceptance, and may be returned. We are unable to accept wires from some restricted countries.

If your financial institution is located outside the United States, wire to:

- JPMChase/Southwest #16867

- 270 Park Ave.

- New York, NY 10017

- ABA transit routing # 021000021

- Swift Address: CHASUS33

- Personal checks must be drawn from a bank account in an account owner’s name and must include Jr. or Sr. if applicable.

- Checks from joint checking accounts may be deposited into either checking account owner’s ACAP Trading account.

- Checks from an individual checking account may be deposited into a ACAP Trading Joint account if that person is one of the account owners.

- Cashier’s check with the remitter name, pre-printed by the bank. The remitter name must be the same as an account owner’s name on the ACAP Trading account.

- Checks must be made payable to Hilltop Securities, Inc. / FBO the ACAP Trading account owner and the ACAP Trading account number. “FBO” stands for “For the Benefit Of.” Example: Hilltop Securities, Inc. / FBO Jane Doe #123456789

- Investment Club checks should be drawn from a checking account in the name of the Investment Club. If a member of the Investment Club remits a personal check, the check must be payable to: “Hilltop Securities, Inc. / FBO the Investment Club name.” “FBO” stands for “For the Benefit Of.”

- Coin or currency

- Money Orders

- Foreign instruments

- Thrift withdrawal orders

- Domestic drafts

- Checks that have been double-endorsed (checks with more than one signature on the back)

- Third party checks not properly made out and endorsed per the rules states in the “Acceptable Deposits” section

- Checks from minors

- Travelers checks

- Credit card checks

- Temporary checks

- Transferring assets from another firm into an ACAP Trading account requires an Account Transfer form.

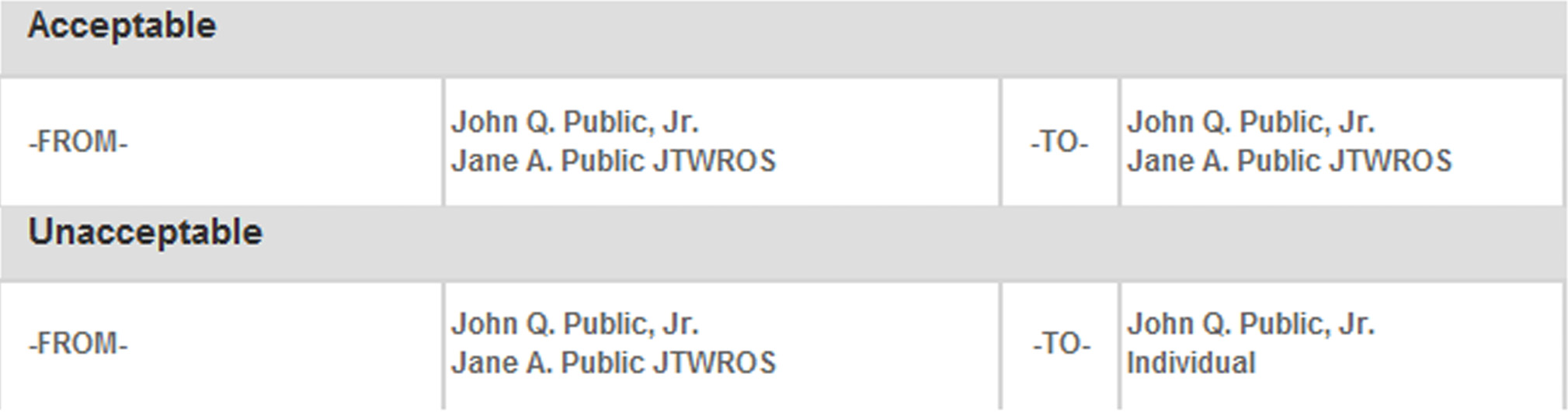

- To protect our clients, it is ACAP Trading’s policy to act only on transfer requests where the name(s)/title on the account to be transferred matches the name(s)/title on the receiving ACAP Trading account.

- Hilltop Securities, Inc.

- Account # 08805076955

- *For Further Benefit (FFB) of:

- Your nine-digit ACAP Trading account number

- Your name

*Required for timely and accurate processing of your wire request.

Please contact ACAP Trading, and not the banks, with questions or concerns about wire transfers.

[/su_tab]

[su_tab title=”Check“]

Check

You can mail a check directly to ACAP Trading to deposit it into your account.

Please refer to these check funding guidelines to avoid having your check returned to you as unacceptable. You can avoid a returned check by using Electronic Funding. It’s a fast, easy, and flexible way to electronically deposit cash into your eligible ACAP Trading account directly from your checking or savings account. Please see the “Electronic Funding” tab or call a Client Services representative at 1-855-846-2227 for details. Please note: ACAP Trading may verify funds prior to posting your check to your account. There is no minimum initial deposit required to open an account with ACAP Trading.

Check Instructions

Sending a check for deposit into your new or existing ACAP Trading brokerage account?

Make checks payable to “Hilltop Securities” (except third party checks – see “Acceptable Check Deposits” below).

Mailing Checks

For new accounts, please submit an Account Application with your check and mail to: 201 N. Civic Drive #360, Walnut Creek, CA 94596-3758

Acceptable Check Deposits

Checks must be payable in U.S. dollars and through a U.S. bank.

Unacceptable Check Deposits

The following are unacceptable deposits:

Please note: This is only a guide, and there may be situations when a remittance is unacceptable.

[/su_tab]

[su_tab title=”Transfer Assets“]

Transfer Assets from one account to another

Transferring assets between two brokerage accounts is easy with ACAP Trading. To expedite your account transfer, the name(s)/title on the account to be transferred must match the name(s)/title on your receiving ACAP Trading account. Please read the important information below.

- Examples of Transfers

(Please note that trading in the delivering account may delay the transfer.)

What to Expect When Transferring Your Account

- Transfer Time Frames

Most total account transfers are sent via Automated Customer Account Transfer Service (ACATS) and take approximately five to eight business days upon initiation. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately 10-20 business days. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer.

- Transfer Assets

Some assets cannot be held at all brokerage firms. This typically applies to proprietary and money market funds. These funds will need to be liquidated prior to transfer. Please contact an ACAP Trading representative to ensure your positions can be held.

- Margin and Options Accounts

If you are transferring a margin and/or options account with an existing debit balance and/or options contract, please make sure that you have been approved for margin/options trading in your ACAP Trading account. Please contact an ACAP Trading representative to ensure your account meets ACAP Trading margin requirements.

- IRA Debit Balances

If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. ACAP Trading may not accept the transfer if the debit balance is too big. You can avoid this by contacting your delivering broker prior to transferring the account.

[/su_tab]

[/su_tabs]