Enjoy low brokerage fees

Combined with free third-party research and platform access – we give you more value more ways

Don’t drain your account with unnecessary or hidden fees. Our transparent, easy-to-understand fee structure means no unexpected charges—and no surprises. Keeping it simple makes it easy for you to keep your costs in check.

Online brokerage account

- Annual account fee – $0

- Minimum initial funding requirement – $0

Retirement accounts

- Annual account fee – $25

- IRA termination fee – $75

- IRA Roth conversion – $0

- Minimum initial funding requirement – $0

Business accounts

- Business investor annual account fee – $0

- Minimum initial funding requirement – $0

Additional services

- Inactivity fee – None

- DTC transfer fee – None

- Account transfer fee (ACAT, out) – $75

- Account transfer fee (Non ACATS) – $150

- Annual safekeeping Fee – $50 per position

- Certificate handling Fee – $50

- Cleared check copy – $20

- Corporate action deposits – $90

- Corporate action physical certificates – $6

- Delivery of book entry securities – $25 per issue

- DRS deposit/withdrawal – $50

- DTCC deposit fee – $12

- DTCC DRS reject fee – $75

- DWAC deposit/withdrawal – $50

- Legal transfer fee – $50

- Pre-payment fee – $20

- Returned deposit item – $35

- Returned (outgoing) wire fee – $25

- Stop payment fee – $25

- Visa platinum debit card annual fee – $50

- Cancelled check fee – $10

- Reorder check fee – $15

- Returned check fee- $25

- Rush check order fee – $22.50

- Stop payment fee – $25

- Paper statements by U.S. mail – $5

- Wire transfer (domestic) fee – $20

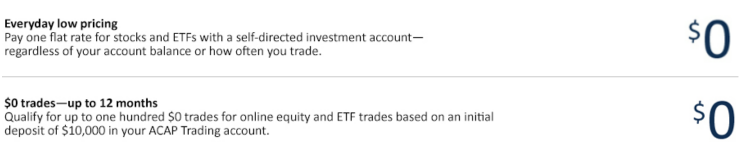

Among the lowest trading rates and fees are right here

At ACAP Trading, our rates are structured specifically to be a better value for active traders. With our competitive commission rates and lower per contact fees, you save more as you trade more. When you trade at ACAP Trading, your dollar works harder and goes farther.

Stocks & ETFs

Options

Mutual Funds

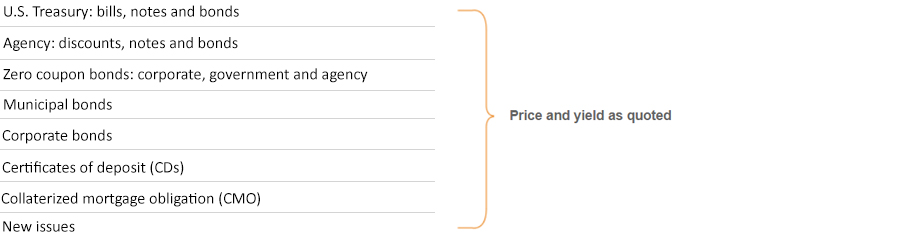

Fixed Income

Use BOLTS™ to view bonds online today

Margin rates

- The base rate is 4.84% effective February 25, 2016. Rates may be negotiable subject to balance of account, marginability of securities, market conditions, fed funds rate, etc. Contact your Representative for more information.

The base rate is set at ACAP Trading’s discretion with reference to commercially recognized interest rates, such as the broker loan rate. Base rates are subject to change without prior notice.